The Indian fintech landscape has experienced remarkable growth over the past five years, thanks to the robust advancements in financial technologies such as UPI, ONDC, and CBDCs. The market has witnessed the emergence of giants like Zerodha and Phonepe, shaping the financial industry’s future. Nevertheless, the fintech domain still brims with untapped opportunities, providing a fertile ground for innovative startups.

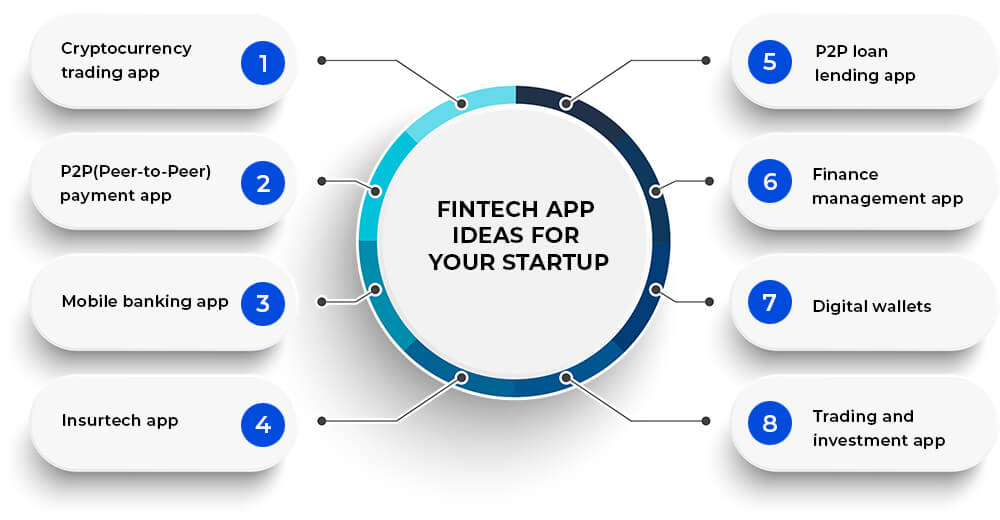

If you’re an entrepreneur looking to venture into the fintech space, having an innovative, high-demand product idea is crucial. Here are five promising fintech startup ideas for Indian entrepreneurs in 2023.

- Invoice Investing App: Invoice investing, also known as invoice discounting, is an area ripe for disruption. It involves short-term loans based on invoice values, promising high returns due to inherent risks. As a startup, developing a user-friendly app for retail investors to invest in businesses through invoice discounting can be a game-changer. Existing players like Invoicemart, M1xhange, and KredX have already shown potential in this sector, but there’s still a vast market to serve.

- Crypto Payment Gateway: The gradual adoption of cryptocurrencies has created a demand for crypto payment gateways. These gateways, built on blockchain technology, enable businesses to accept both fiat and cryptocurrency payments. Despite the presence of payment gateway giants like Razorpay, there’s a distinct gap in the crypto payment processing market. By developing a secure, easy-to-use crypto payment gateway, you could potentially tap into this growing market.

- Crowdfunding App for Startups: A platform that connects retail investors with startups can democratize investment opportunities. While some platforms, like Tyke, have begun to serve this market, there’s room for more players. Creating a trusted, transparent platform that allows retail investors to back startups with a minimum investment could be a lucrative venture.

- Personal Finance for Freelancers: The growing freelance community in India, projected to be worth $20-30 billion by 2025, presents a unique opportunity. Traditional personal finance services often fall short of addressing freelancers’ specific needs. By developing a comprehensive finance app for freelancers, you can help them manage payments, taxes, and savings, presenting a tailored solution for a niche yet substantial market.

- Decentralized Finance (Defi) Platform: Decentralized finance, or Defi, represents the cutting-edge of fintech. Startups like Defy, CoinDCX, and WazirX have started to capitalize on this trend, but there’s a gap in services catering to the traditional market. A Defi platform offering lending and borrowing services for both crypto and fiat currencies could be the solution this market needs.

India, with an 87% global adoption rate, surpasses the global average of 64% and boasts the third-largest fintech ecosystem in the world. With over 2000 DPIIT-recognized Financial Technology (FinTech) startups, the Indian fintech scene is a beacon of innovation. These startup ideas can provide a launching pad for your entrepreneurial journey, potentially shaping India’s fintech future.